As the global economy continues to shift, understanding which countries are driving growth—and why—can provide valuable context for investors, business owners, and professionals making international decisions. According to the International Monetary Fund (IMF), the world’s 20 largest economies in 2025 tell a story of shifting power, emerging markets, and the long-term impact of recent global events.

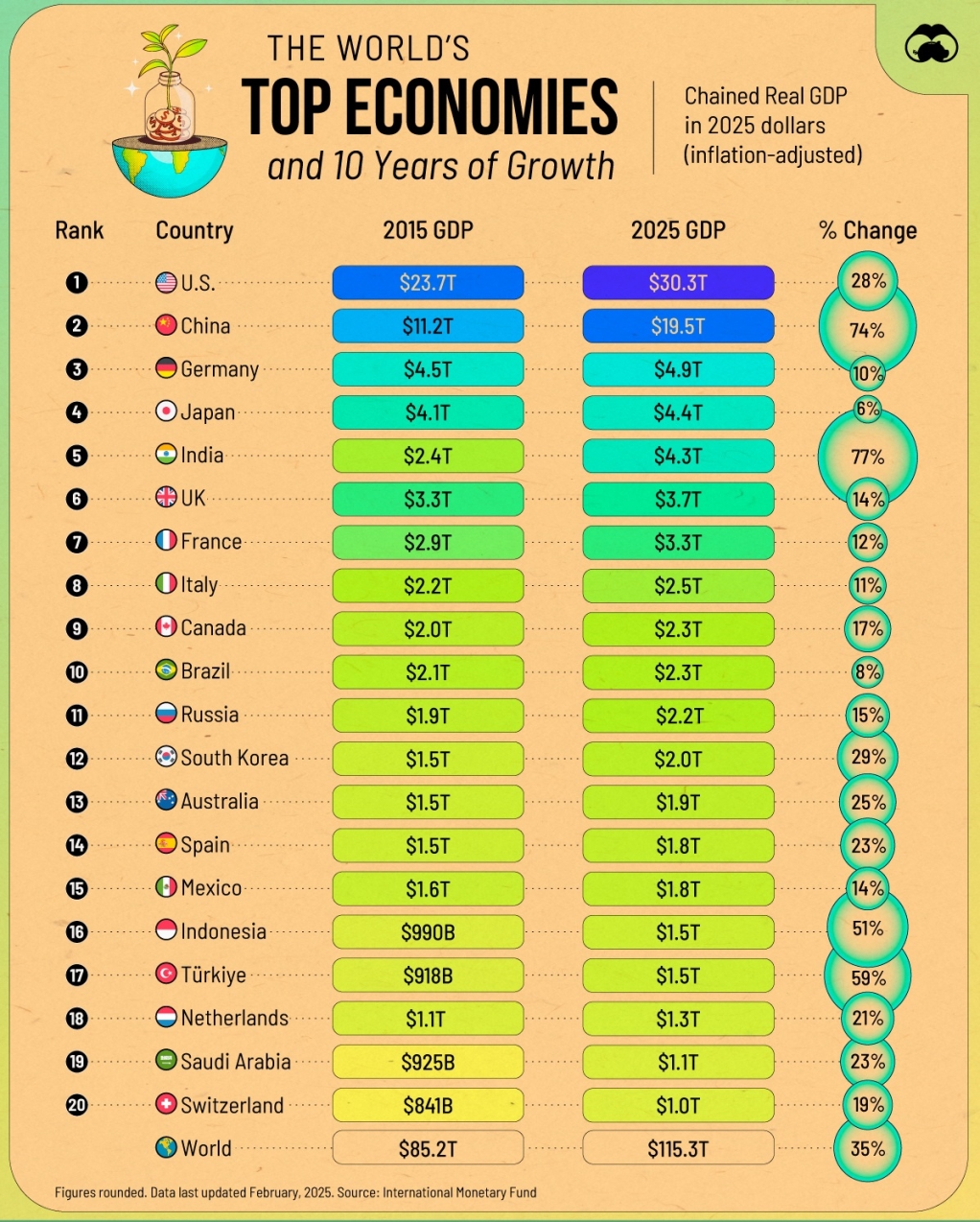

In this infographic, GDP is ranked by projected size in 2025, adjusted for inflation and expressed in constant dollars.

Key Takeaways from the Past Decade of Economic Growth

1. China’s Trajectory Adjusted, India on the Rise

A decade ago, many economists expected China to surpass the United States as the world’s largest economy. But a series of headwinds—including pandemic-related slowdowns and a cooling real estate market—have moderated China’s ascent. Still, the country has grown its GDP by over 70% since 2015, building on an already massive $11 trillion base.

India has matched that growth rate and, given its momentum, has surged into the top five global economies. Once ranked behind the UK, India is now projected to overtake Japan this year and Germany by 2027, positioning itself as a long-term growth leader in Asia.

2. Emerging Markets Are Making Moves

Indonesia and Turkey posted some of the most impressive growth among the top 20, with inflation-adjusted GDP increases of 51% and 59%, respectively. Turkey’s gains come despite economic volatility, including high inflation and currency depreciation. These nations reflect a broader trend: emerging economies are playing an increasingly important role in global wealth creation.

3. Brazil's Slower Recovery

Among the top 20 economies, Brazil has seen the slowest growth, with only an 8% increase in real GDP over the last decade. The 2014 commodity crash sent the country into a prolonged recession, and although recovery began, the pandemic created another setback. That said, Brazil’s trade and investment activity has since returned to pre-pandemic levels, and it remains a pivotal player in the global commodities space.

What This Means for High-Net-Worth Individuals and Legal Professionals

For investors seeking global investment opportunities or assessing macroeconomic risks, these trends offer valuable insights. Countries like India and Indonesia may present growth-oriented opportunities, while stability in traditional markets like the U.S., Japan, and Germany continues to offer a hedge against volatility.

At Samalin Wealth, we help our clients navigate complex financial landscapes with clarity and strategy. Whether you're exploring global investments, optimizing your tax exposure across jurisdictions, or simply staying informed, understanding where the world’s economic power is headed can help guide smarter decisions.