In 2024, nearly every S&P 500 sector delivered gains, fueled by strong AI-driven momentum and a resilient U.S. economy. Two-thirds of companies closed the year in positive territory, contributing to the index’s strongest two-year performance since the late 1990s.

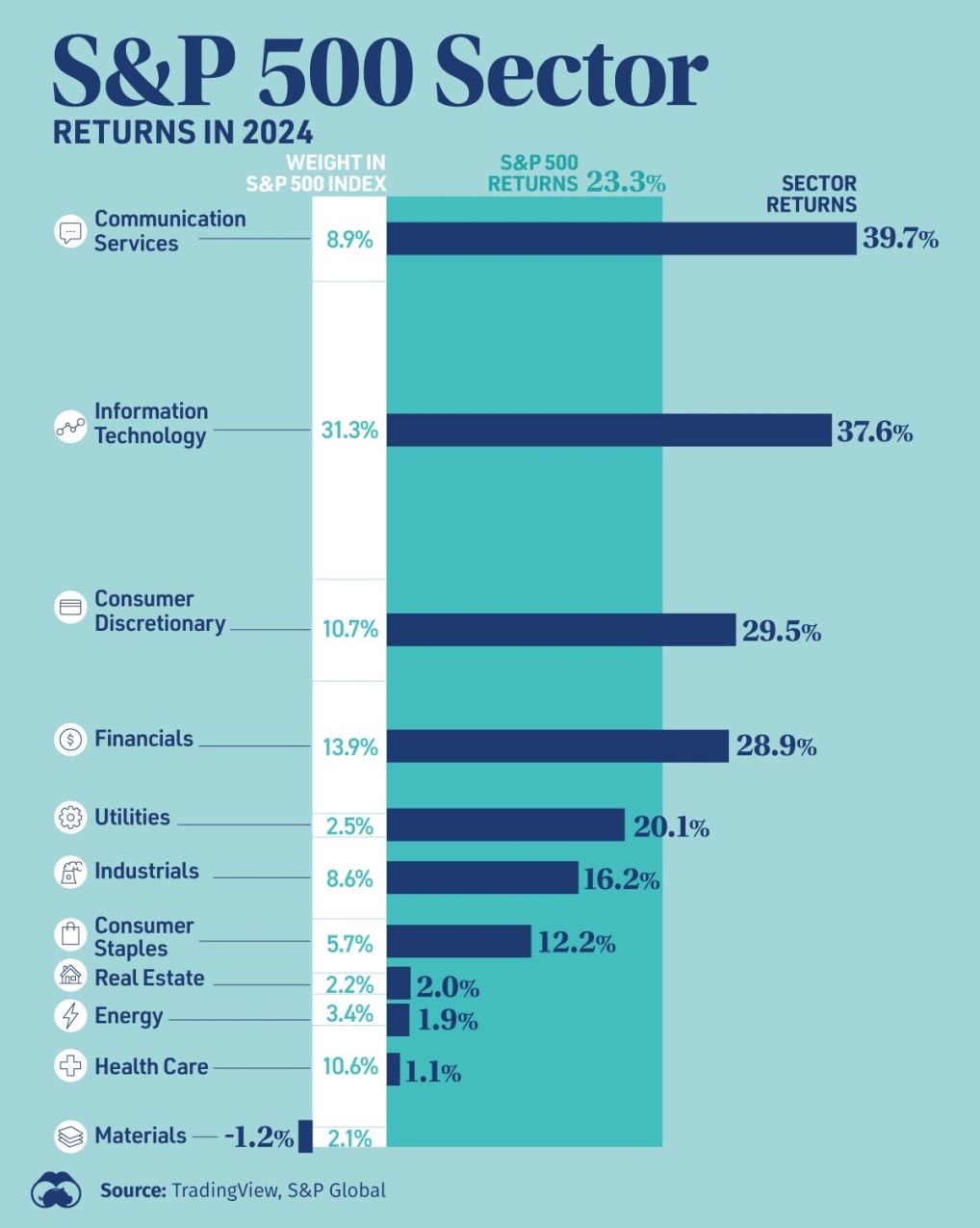

This infographic breaks down sector returns across the S&P 500 for 2024, highlighting each sector’s relative weight in the index.

Key Drivers Behind Market Performance

Communication Services led the way, driven by surging digital advertising revenues and robust consumer spending. Close behind was Information Technology, powered primarily by a handful of dominant tech giants that fueled sector outperformance.

The Financials sector also exceeded expectations, supported by some of the lowest price-to-earnings ratios across the index. A combination of interest rate cuts and the market’s reaction to Trump’s re-election boosted bank stocks, as lower rates typically spur lending activity.

Utilities saw a remarkable turnaround from 2023, benefiting from increasing electricity demand driven by AI hyperscalers.

Conversely, Materials was the only sector to post negative returns, pressured by China’s economic slowdown and persistently high interest rates.

Looking Ahead: Market Dynamics in 2025

Market conditions are constantly evolving and can impact sectors differently over time. At Samalin Wealth, we focus on helping clients navigate these shifts with diversified, risk-managed strategies tailored to meet long-term financial goals.

Remember, stock values fluctuate with market conditions. Returns are not guaranteed, and diversification, while an effective risk management strategy, does not assure a profit or protect against losses.

Data sources: TradingView, S&P Global. Graphic by Visual Capitalist.